If you are there clearly was additional scrutiny having financial apps off this new worry about-employed, it doesn’t should be a primary challenge to borrowing.

Because the a traditional personnel, exhibiting proof money is as easy as providing your bank along with your latest payslips. To possess self-employed individuals, it can be more complex. It generally does not should be a major topic; loan providers need your company anyway, nevertheless the process of verifying which you earn sufficient currency in order to pay home financing can be more thorough. Lenders usually have stricter requirements with the self-working consumers, and generally you need info become satisfied the risk isn’t really unsuitable.

A career size

Around australia, particular lenders has minimal conditions based on how enough time a borrower has actually started care about-operating. Such as, many loan providers like a beneficial borrower’s organization to have become based otherwise exchange for around a couple full economic many years.

However, additionally it is worthy of leading certain loan providers have significantly more flexible criteria, possibly provided people with a shorter chronilogical age of notice-a career, particularly if he has an effective credit score, substantial discounts, otherwise can display the business is within a very good budget having good earnings. Lenders elizabeth world before you go self-employed (a professional electrician who has got has just went for the company for themselves, like) to use old payslips and you will sources in order to enhance its software.

Inconsistent earnings

Self-operating consumers normally have income one to varies, rather than team just who have the same salary package a week. An air conditioning repair people instance might look for a rise in operation from November so you can March, after that end up being significantly less hectic for the cool months. This will create more complicated to show a constant budget and could suggest a loan provider requires much more information.

Higher costs and you can charges

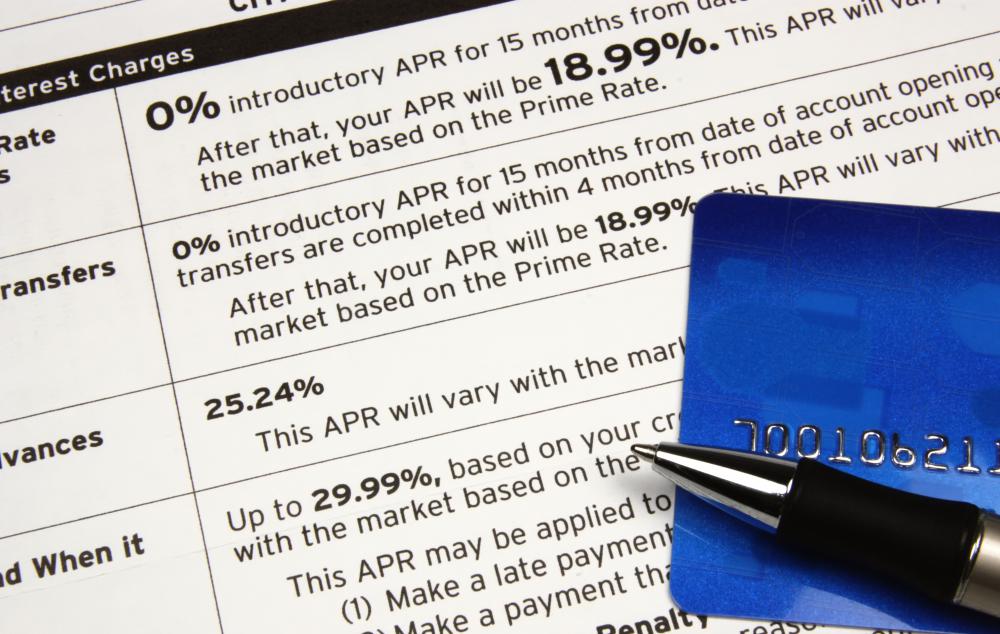

Because the worry about-working consumers are often regarded as large-risk, this may mean large rates of interest otherwise a lot more costs compared to borrowers that teams.

So much more analysis

Self-operating consumers will go through a far more rigid analysis of their app. Loan providers need even more documents such as profit and loss comments, providers financial statements or GST returns to assess the medical and you can stability of your own providers.

Simply how much put manage I wanted to own a self-employed financial?

Fundamentally, you want a much bigger deposit compared to anybody with a normal Pay-as-you-go earnings. To possess thinking-working anybody, lenders typically need in initial deposit of at least 20% of one’s property’s well worth. Which demands is especially considering the observed greater risk associated that have thinking-employed earnings, and that is alot more varying and less foreseeable than just a frequent paycheck.

Will it be difficult to get a home loan worry about-working?

Securing a mortgage when you’re thinking-operating is actually establish way more demands compared to the individuals with good typical money. Loan providers scrutinise debt balance and you will money texture far more closely. They typically wanted at the very least two years regarding providers economic statements, taxation statements, and you will observes from evaluation to verify your income. So it documents helps loan providers determine your ability so you can service the loan.

Even though it is much https://www.paydayloanalabama.com/linden harder, its definitely not hopeless. Many lenders understand the character out-of notice-employed money and offer particular mortgage circumstances designed to satisfy these types of novel facts. It’s important to maintain your monetary ideas inside an effective acquisition and you will be prepared to show consistent earnings more two years.

Money verification having thinking-operating mortgage brokers

You will find several some other files lenders might require in the place of payslips. Here are some of the most prominent, but it is not an enthusiastic thorough record. Depending on the problem, loan providers you are going to require most other info and you can data files, so if you was notice-operating and you may thought you may be searching for an effective mortgage in the some phase, it pays to keep organized together with your financial information.