If you’re not entirely sure how your COVID-19 financial forbearance really works, when it comes to an end, what you’ll perform in the event it closes, or the way it impacts your money finally, you’re not alone. More than eight.step three million Western people possess joined to your financial forbearance because the start of COVID-19 pandemic, and as off , nearly dos mil were still within the forbearance programs and you will probably thinking regarding their log off bundle – leaving most of them inquiring, now what?

Another blog post will allow you to know what you will want to know about COVID-related mortgage forbearance, whether you are seeking to offer it, exit it, otherwise come back focused economically after they. Some tips about what we will protection (click on all following the bullets so you’re able to plunge to help you a style of area):

Information Home loan Forbearance

Mortgage forbearance are a binding agreement anywhere between you and your financial one enables you to build lower payments or suspend payment for the a good brief basis up until you are in a far greater put economically. It typically doesn’t affect your credit score in the same way a foreclosures do, so long as you was basically latest on your own mortgage in advance of the new established forbearance period.

No matter if home loan forbearance resided before, the global COVID-19 pandemic triggered the brand new forbearance solutions having You.S. property owners because of the adversity the pandemic triggered.

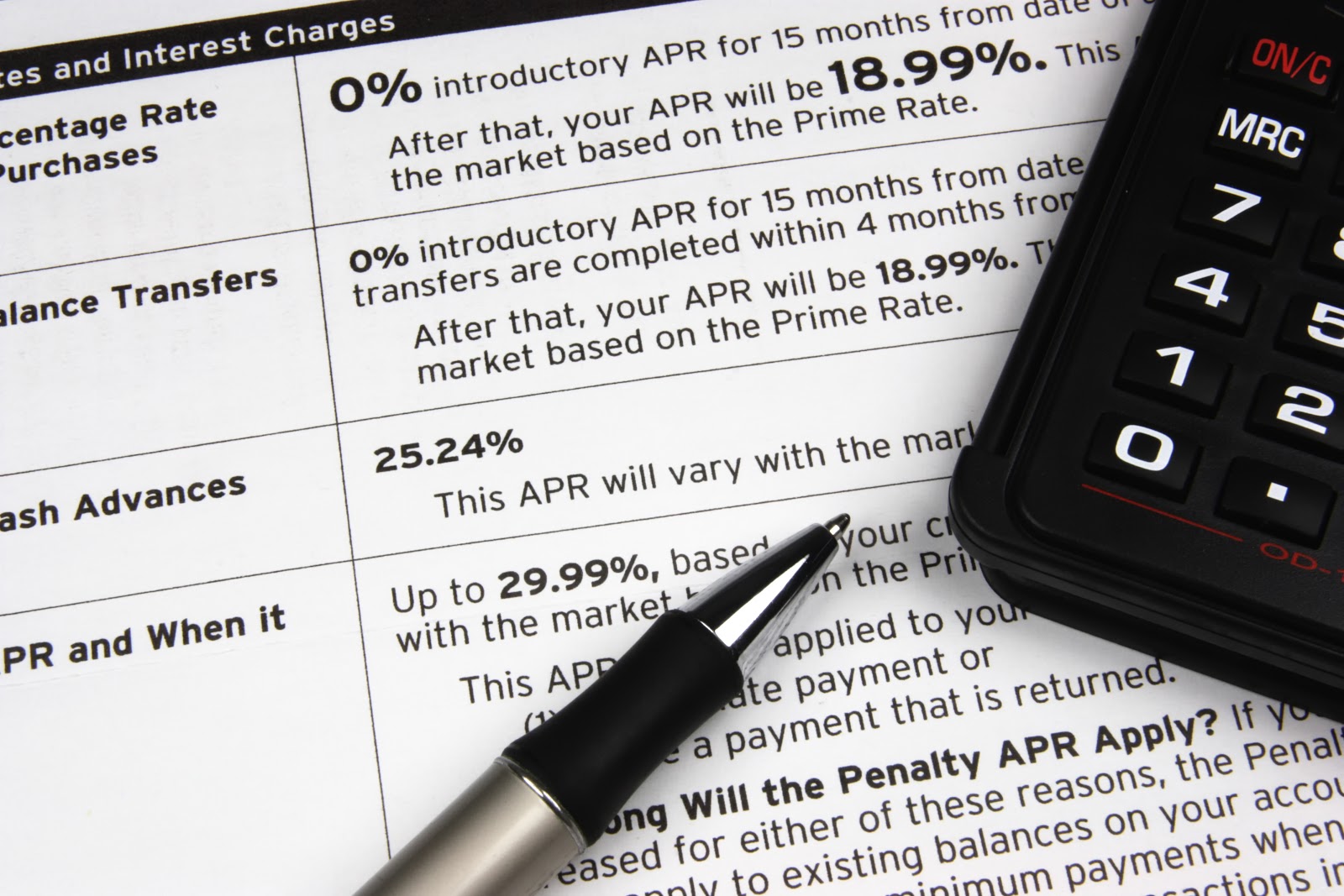

The new information on your forbearance arrangement count on your unique lender, however the terminology will most likely target facts together with your commission amount during the forbearance, just how long the brand new save will last, the method and you may time getting repayment, and you can if the lender will report their forbearance condition to credit agencies.

Forbearance is not financing forgiveness, and ought to not thought a beneficial totally free drive – you may be necessary to make up for the brand new missed costs. People focus that financing accrues less than normal facts will stay to achieve this using your recovery program also. Possible however located monthly statements from your lender.

The latest CARES Act

The fresh CARES Act are some government rules finalized to your law into the once the a result of this new COVID-19 pandemic. It signifies Coronavirus Services, Rescue, and you can Monetary Security Operate, also it involves this new $dos.2 trillion monetary stimuli bill to simply help brand new drop out due to new pandemic and you can further occurrences. When it comes to home loan forbearance, government-recognized mortgage loans try secure around this act, however, in person-held mortgages commonly. This is why the private lenders are the ones within the will set you back out-of forbearance, thus its details, timelines, and you may qualifications can differ off authorities-supported loans.

Sort of Loan Forbearance

There are different types of financial rescue advice, based on your unique loan, even so they always fall under one or two buckets:

-

- A whole deferment regarding costs

- A somewhat shorter amount monthly during the a-flat period of time (generally speaking no more than just one year)

The newest regards to your forbearance might trust should your financial are regulators-backed, myself financed by a financial, and/or perhaps is connected with COVID-19-novel forbearance solutions. If you’re not yes when your mortgage try regulators supported or not, you may have several means of studying. One particular head way is to make contact with your servicer myself. Your mortgage statement will indicate just who your servicer is actually and ought to bring a contact number on exactly how to phone call. You can even consider on line to see if your loans in Noank home loan was backed by Fannie mae otherwise Freddie Mac computer.

Forbearance Repayment Solutions

People are responsible for calling their lender to determine exactly how they’re going to pay back its overlooked payments and also have its mortgage straight back towards the song. Repayment agreements are performed towards the one basis. Simply put, there is no cookie-cutter approach that actually works for all property owners and choices are different because of the financial as well.