What you’ll learn

- What is a home loan deposit?

- How much cash deposit must purchase a house from inside the NZ?

- So why do loan providers love my home loan deposit?

- So what can I prefer to possess my home loan deposit?

- Utilizing your KiwiSaver for your house mortgage deposit

- What is the Very first Mortgage design?

- Brief tricks for rescuing having home financing deposit

If you’re simply performing on the property travel from inside the Brand new Zealand, you are probably finding another world of slang. This is also true with respect to the finances from to invest in a property. And additionally the terms and conditions, you will probably end up wading using a whole bunch of data to things such as mortgage places, rates of interest and you can mortgage repayment computations.

To acquire to help you grips with this specific content, we’re going to zero from inside the on one of the most important what you should see financial places.

We’re going to see just what a mortgage deposit is, how much cash you might you prefer, and many of the ways you can purchase indeed there.

The regular expertise would be the fact you’ll want to save up a good deposit that’s equivalent to 20% of your property value the house we want to buy. When you look at the , the Assets Speed Index indicated that the $5k loans Pritchett average family price into the Aotearoa The new Zealand are $866,000. So, taking 20% of that will give your the typical needed deposit regarding $173,200. Naturally, this really is a nationwide average, very some places (elizabeth.g. Auckland and you can Wellington) will be high, while others (age.g. Southland) might be straight down.

But not, it’s possible to discover reduced put mortgage brokers into the NZ, in which you might only must be able to provide 5% or ten% of the property price tag in order to be provided an excellent financing. Bringing the national average possessions rate example, 5% with the is $43,three hundred. The first Financial design is but one like instance of how to find a cheaper deposit, and we’ll talk about that it more lower than.

Exactly why do lenders worry about my home loan put?

When a loan provider agrees to help you mortgage your currency they truly are essentially delivering a threat you will be in a position to outlay cash straight back, so there are a number of things that they are doing in order to give them comfort.

By the assessing how much cash you’ve been in a position to conserve getting property deposit, the lending company gets a sense of just how risky you are having these to provide so you’re able to. If you have a bigger put, it is likely that you’re in both a properly-spending employment, or you happen to be a great saver. Otherwise if at all possible, on bank’s direction, you are one another. So, by the protecting up a more impressive deposit, you’re likely to get a larger mortgage offer on the bank in return.

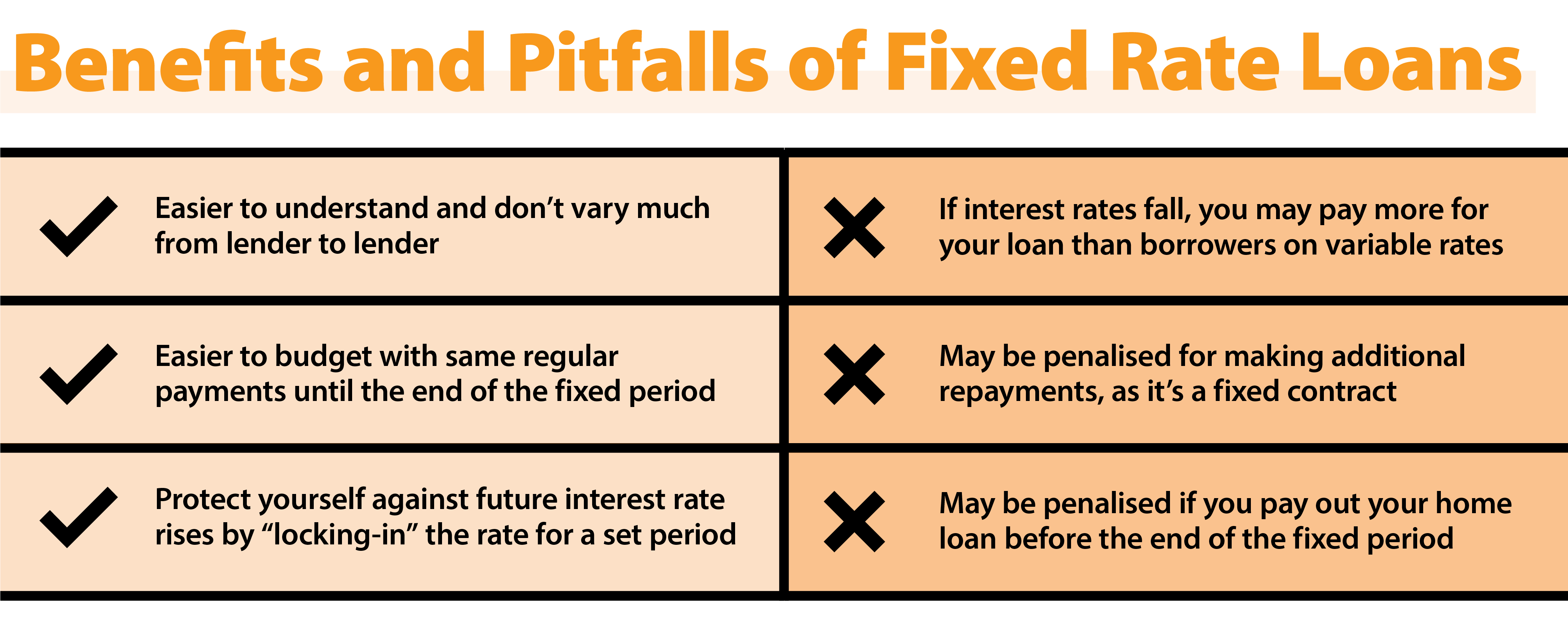

One other way having banks in order to counterbalance their exposure would be to fees interest levels. Besides so is this an easy method toward lender to truly make money, but it also incentivises one afford the financing of smaller. Brand new a shorter time you’re taking, the fresh new reduced you pay during the appeal. Expanding interest rates is also something banks is going to do if the they offer a decreased put mortgage. Lending money to people having a smaller sized home deposit concerns an excellent higher risk (because financial is providing more of their cash up front) so they can charge increased rate of interest to pay.

Exactly what do I prefer to own my mortgage put?

Lenders aren’t only wanting how much cash you have conserved, but also where it is come from. Of several financial lenders for the NZ will require you to definitely at the very least 5% of your house financing put arises from legitimate savings’. Genuine deals form money which you have indeed saved up on your own, usually by putting away a proportion of your earnings away from for each and every pay cheque, otherwise throughout your KiwiSaver. Bucks merchandise away from family unit members cannot count because geniune offers.