Lauren Caggiano

Lauren Caggiano is good Fort Wayne-centered copywriter and you can publisher which have an excellent nerdy love of AP Build. Inside her sparetime, she keeps volunteering, thrift shopping, physical fitness and you may traveling. Discover more on her behalf site: lovewriteon.

You could have heard about FHA money because the a first-go out homebuyer, but that isn’t the only real group who can make the most of so it home loan type. We have found a check this out mortgage in addition to extremely outstanding have to help you decide if it is a financing solution now otherwise later on.

Just who qualifies having an FHA Financing?

In a nutshell, FHA funds are not reserved exclusively for basic-big date people. One debtor, and additionally very first-time and recite of these who meet up with the lowest degree standards can be qualify. Men and women criteria become a downpayment off step three.5%, a good quantity of financial obligation, and you can a credit history off five hundred or maybe more. You should observe that 500 ‘s the credit score cutoff used by the fresh Agencies of Property and you will Metropolitan Creativity, hence takes care of the applying. Certain lenders may require higher results.

How does an enthusiastic FHA Loan Works?

To learn as to the reasons FHA fund are so preferred among very first-big date homebuyers, it can help to seem beneath the hood sometime. The latest Government Construction Government doesn’t give currency to individuals. Brand new organization makes sure funds that are generated in individual sector from the lenders. You will need to note that that it insurance rates protects the financial institution, maybe not new debtor. Say a home customer who spends an FHA financing ends up spending towards the home loan later on. In this case, the lender is going to be secure to possess monetary loss. So essentially, the loan bank helps to make the financing, therefore the federal government means it up against prospective losings.

Due to this grounds, FHA lenders are apt to have significantly more flexible certification conditions when versus antique mortgage loans. For this reason basic-date homeowners usually see they better to become approved getting an enthusiastic FHA mortgage as compared to conventional mortgage points. It is one of the reasons first-time consumers tend to pursue FHA funds.

The fresh new advance payment state may also make a keen FHA loan amenable so you’re able to newbie homeowners. That’s because brand new FHA financing system now offers among the many reduced down-percentage selection of all financial apps, apart from Virtual assistant and you may USDA funds. Less than FHA mortgage guidance, borrowers tends to make a downpayment only step 3.5% of your own purchase price or even the appraised value, whichever is leaner. That implies when you find yourself buying a home to own $175,000, you simply you need a small more than $6,000 for your deposit.

Another important distinction is that the advance payment is talented regarding a 3rd party, such as a member of family otherwise close friend. This helps in the event the borrower was secured for the money.

Qualifying to possess an FHA Loan

And work out a down payment is not the simply barrier so you can entryway, but not. You are wanting to know when you are within the a state so you can qualify to own a keen FHA mortgage. As mentioned above, the minimum credit score to possess an FHA financing is actually 500. It might help to be aware that in the event the rating drops ranging from five-hundred and you will 579, you could nevertheless be considered, however, a very large down payment are expected. Along with, do not be astonished to find out that individual loan providers is also decide to want a top minimum credit rating.

Past credit score, you will have to make certain you are not overextended economically so you’re able to meet the requirements to possess an enthusiastic FHA mortgage. The latest FHA requires an obligations-to-income (DTI) ratio regarding lower than 50 – their full month-to-month financial obligation costs cannot go beyond 50% of one’s pretax income.

Get eye towards a fixer-top? Maybe not so fast. The brand new FHA keeps specific statutes regarding your style of household your can acquire which have an FHA mortgage. Anticipate securing an appraisal that’s separate (and other out-of) a property review. This will be a kind of due diligence, because the FHA desires to make sure the residence is good funding and you can matches payday loans no credit check Northglenn safeness and livability criteria.

Insurance policy is something else entirely you will need to package and cover. FHA financial insurance is factored for the most of the loan. Just like the mortgage is actually got its start, you can easily create an upfront mortgage insurance fee (and is folded toward total quantity of the borrowed funds), and also make monthly premiums thereafter.

If you make a downpayment off less than ten%, you may shell out mortgage insurance rates toward life of the borrowed funds. Although not, for individuals who choose to establish ten% since a down-payment, expect to pay FHA financial insurance to own 11 ages.

What is going to disqualify you from a keen FHA loan?

A home price above the FHA’s mortgage limits for the neighborhood often disqualify the job. Purchasing a residential property otherwise a secondary home are also disqualifiers.

On monetary side of the home, a loanstoearnings proportion (DTI) significantly more than fifty percent or a credit score lower than five hundred tends to make taking acknowledged almost impossible unless you extra a beneficial co-borrower who will help eliminate the extra weight.

Just what are other available choices along with an enthusiastic FHA mortgage?

For individuals who dictate an enthusiastic FHA loan may possibly not be a knowledgeable fit for your, there are a few additional options to consider.

Traditional financing – A traditional mortgage setting your home loan isn’t section of an authorities system. There’s two types of old-fashioned money: conforming and low-compliant. A conforming loan observe recommendations lay because of the Fannie mae and you can Freddie Mac computer instance restriction mortgage numbers. A non-compliant financing can have significantly more variability toward eligibility or any other issues.

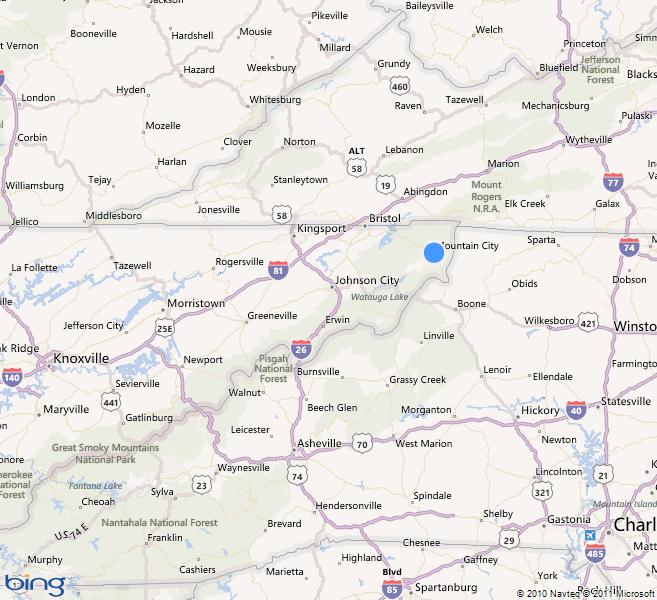

USDA loan – Good USDA loan, also called a rural innovation financing, may be a choice for those with low-to-moderate incomes who live inside rural parts. They are obtainable as they offer zero off repayments, regardless if you are going to need to pay an initial fee and mortgage insurance coverage advanced.

Va loan – Va money are designed to eligible consumers by the individual lenders however, insured because of the Company away from Veteran Activities. You will be able to make a low deposit (otherwise zero advance payment). You’ll likely need to pay an upfront payment from the closing, however, monthly financial insurance fees are not required.

Exactly how tough could it be to find an FHA financing?

FHA funds down barriers of getting a mortgage approval. Nevertheless, the simple truth is the travel to homeownership, regardless of loan form of, requires perseverance and you can patience. Out-of pre-acceptance to closing, there are numerous really works that must be over with the the newest customer’s avoid to succeed.

Regardless if you are an initial-day homebuyer or was indeed down which road ahead of, we invited your questions regarding the FHA financing. And better yet, i stroll with you each step of the means. Of the outlining the process, responding questions, and easily discussing training, we make the guesswork out of this journey. There is also brand new assurance basis. Their Ruoff mortgage administrator will ensure things are on track and that which you happens smoothly so you can has a spot to label domestic nice domestic sooner than after.