Article Note: The content for the post is dependant on the new author’s opinions and pointers by yourself. It may not was basically analyzed, commissioned otherwise recommended by any of the system lovers.

Military consumers which have bumps within their credit history may find it easier than they think locate accepted having a great Virtual assistant domestic financing having poor credit. Taking specific energetic-duty and resigned service professionals deal with financial demands one to civilians dont, the new U.S. Institution of Experts Issues (VA) might make sure mortgage loans to own veterans with big credit issues, such as for example bankruptcies and you will foreclosure.

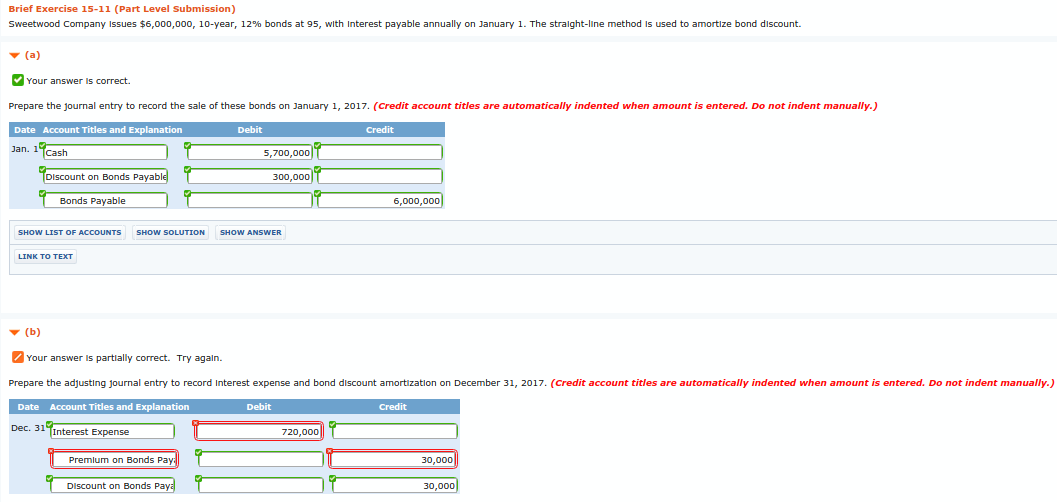

- Could i score an effective Va loan having bad credit?

- Style of Virtual assistant money you can get which have bad credit

- Just how Virtual assistant bad credit fund compare to other mortgage apps

- Va fund along with your CAIVRS record

Is it possible to rating good Va loan having poor credit?

The simple address: sure. Virtual assistant recommendations was built with brand new special requires out-of military borrowers at heart. The latest disturbance away from treat deployments and you can adjusting to civilian lives immediately following active-obligations solution can sometimes end up in additional economic difficulty getting army group.

- No lowest credit history. There is absolutely no minimum credit rating set by the Virtual assistant, while most lenders wanted an excellent 620 minimal score. Although not, the very last 12 months away from commission history was scrutinized directly, especially their lease or mortgage repayments. You are in a position to beat a dismal credit payment background having grounds or proof active-obligation deployments or impairment-related fitness challenges.

- 2-year wishing period shortly after a part 7 bankruptcy. The latest Va are responsive to services-related conditions that can result in bankruptcy filings. Military borrowers need wait only 2 years off their case of bankruptcy discharge big date to try to get another Va mortgage (in contrast to four years having a normal financing).

- one year off costs to the a chapter 13 case of bankruptcy or credit counseling. Virtual assistant borrowers who have produced 12 for the-go out monthly obligations within a chapter 13 case of bankruptcy or borrowing counseling program may be eligible for another type of Virtual assistant financing.

- 2-season wishing period after a foreclosures. Armed forces borrowers which shed a house so you’re able to foreclosures qualify to have an effective Va financing immediately after a couple of years blog post-closing.

- Virtual assistant property foreclosure flexibility. Virtual assistant consumers usually takes aside a different sort of Virtual assistant financing, even with an excellent foreclosed Va financing to their certificate of eligibility. When you have adequate Va entitlement kept, you will be able to buy an alternate home with no down-payment.

Kind of Virtual assistant loans you can purchase that have poor credit

Whether you get a loan having bad credit so you can re-finance or buy a home, the Virtual assistant borrowing standards are basically an identical. Readily available Va loans types tend to be:

Virtual assistant pick financing . Virtual assistant consumers to order a home which have less than perfect credit can be eligible for no deposit and no home loan insurance rates (a form of insurance coverage recharged of many mortgage brokers for those who create lower than good 20% deposit). Should your fico scores is low, loan providers pays close attention to exactly how you’ve paid the lease or any other debts in earlier times 12 months.

Va dollars-away re-finance financing. Property owners can use a great Virtual assistant mortgage to obtain as much as ninety% of their residence’s value, tapping additional security to evolve their house or pay off high-desire credit profile. A bonus: Paying credit cards which have an excellent Va bucks-out re-finance you can expect to increase scores and that means you don’t need a less than perfect credit financial later.

Virtual assistant interest rate prevention re-finance finance (IRRRLs). Borrowers which have a current Va mortgage only need to prove they usually have made its costs on time going back 12 months to be entitled to good Virtual assistant IRRRL. Domestic appraisals and you can money data are not necessary, and settlement costs can be rolled toward amount borrowed. Even if you was thirty days later https://paydayloancolorado.net/shaw-heights/ toward a recently available financial commission, their lender can still accept an IRRRL by distribution the loan right to the brand new Va getting recognition.

Special note regarding Virtual assistant settlement costs and you will bad credit

The reduced your credit rating, the greater the chance there clearly was that you may default with the the loan. Lenders determine it chance from the billing a higher interest rate. This can generate getting good Virtual assistant financing which have poor credit significantly more problematic for 2 reasons:

Financial settlement costs is capped during the 1% of one’s loan amount. In case the interest comes with write off facts on account of an effective reduced credit rating, the total will cost you will get surpass VA’s 1% maximum to your overall financial costs. If so, you may not qualify for Virtual assistant financial support.

Va refinance money wanted good 36-times breakeven towards the closing costs. To help you be eligible for a beneficial Va re-finance, the financial institution need to show you can recover their settlement costs contained in this thirty-six weeks, known as the break-also part. Breakeven is actually calculated because of the splitting your own total will set you back by the month-to-month savings. If the large discount points analyzed on account of bad credit set you beyond now body type, you might not be eligible for an effective Virtual assistant refinance.

How Va less than perfect credit fund compare with most other loan applications

This new table lower than highlights the difference from inside the Va borrowing from the bank standards in the place of most other common mortgage applications, such as for example antique fund, FHA finance insured by the Government Housing Administration and you may USDA fund supported by new You.S. Company of Agriculture:

Va funds as well as your CAIVRS record

The financing Alert Entertaining Verification Reporting Program (CAIVRS) is actually a databases loan providers used to look for one non-payments for the federally assisted finance. What is actually built-up centered on overpayments to own studies advantages, disability positives or Va foreclosures says.

You have difficulty delivering acknowledged having a government-backed home loan in case the CAIVRS record is not clear. Yet not, Va loan providers might be able to generate an exception to this rule in the event that an effective delinquent account might have been lead newest, or you have made into-time costs included in a repayment plan.