What is a steady money as well as how can it apply to their home loan?

Therefore, you’re interested in to order a property and you also need certainly to get out home financing. Once you sign up for a home loan, you will have to demonstrate that you can afford brand new month-to-month financial money and that you want to spend the money for cash return.

You will need to meet with the money standards to the loan and you will section of that are demonstrating that your earnings was secure and you can normal.

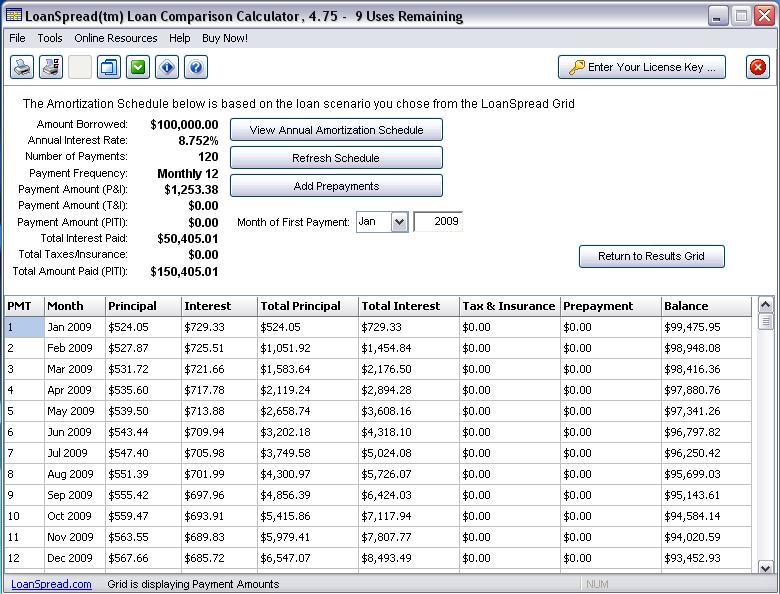

It’s a good idea to check out how much you can afford to borrow using a home loan calculator before loans in Goshen you speak to lenders, but remember, it’s only a guide and not a firm mortgage offer.

Trying to get a home loan your revenue listing

- Exactly how much is the income? Do you spend the money for financial?

- Preciselywhat are the outgoings labeled as the debt-to-income ratio (DTI)?

- Is your earnings secure? Can you get the exact same number on a regular basis on same provider?

- What is actually your credit rating such as?

- Are you care about-operating and do your earnings vary? Do you have a two-season reputation for worry about-a job demonstrating that your income try secure otherwise ascending?

Obtaining the loan earnings confirmation

After you get home financing, you will have to show your earnings. While you are inside the regular a position, you’ll do that by giving the financial institution plenty of the latest payslips and your most recent W-2 means. You will need a letter from your own manager, particularly if you have been in your employment for under a few years, plus they also can demand your last several years’ government income tax efficiency directly from the fresh Internal revenue service.

But there is however far more so you can they than simply appearing your earnings. You happen to be more inclined in order to safer home financing for many who is also demonstrate that your income was stable, and it’s important that you enjoys a reliable money particularly at the the time out of obtaining the borrowed funds. The a career problem you will change once you have finalized in your financial, but providing you can consistently pay the home loan repayments, you shouldn’t encounter difficulties.

What are the earnings conditions for home financing?

Additional loan providers provides additional requirements and additionally, this will depend about how exactly much you have made and exactly how far you want to acquire. However, an usually-quoted laws would be the fact your monthly mortgage repayments, including assets fees, also homeowner’s insurance, really should not be more than twenty-eight% of one’s revenues.

For individuals who include almost every other costs (credit cards and you may auto loans, such), the complete outgoings nevertheless must not be more than thirty six%. This can be called the debt-to-earnings ratio or DTI.

It is far from place in stone no matter if whether your credit history is truly a, or if you has actually an enormous down payment, such as for example, certain loan providers are going to be versatile, so there also are borrower software which do not follow the standard earnings criteria for a financial loan.

It might assist if you have an excellent existing experience of a specific financial after you get their home loan. Whenever you can reveal you have came across any money toward a beneficial previous home loan otherwise loan, or if you provides a current account with them, they may keep this in mind. In summary confer with your lender to find out how much cash you might be approved to use.

What’s a stable earnings?

For the mortgage conditions, a reliable money means income which is paid in an appartment or repaired matter on exact same source towards the a great regular basis. Instance, payslips from your own workplace will teach you will get a normal source of income.