Here is how cost and you may focus-only mortgage loans work with Ireland together with various ways to repay your home loan regardless if you are an initial time consumer, buy-to-assist investor or switcher.

- Cost financial: The sum you have borrowed, plus desire, try slowly paid back over your preferred mortgage label for the a month-to-month base. Extremely home-based housebuyers pay its loan that way.

- Interest-only home loan: You can only pay the loan attention inside name as well as the funding was paid off in one single lump sum payment towards the bottom. Buy to allow investors will get prefer this package and it’s really possibly offered to self-designers to have a restricted period.

What is a repayment mortgage?

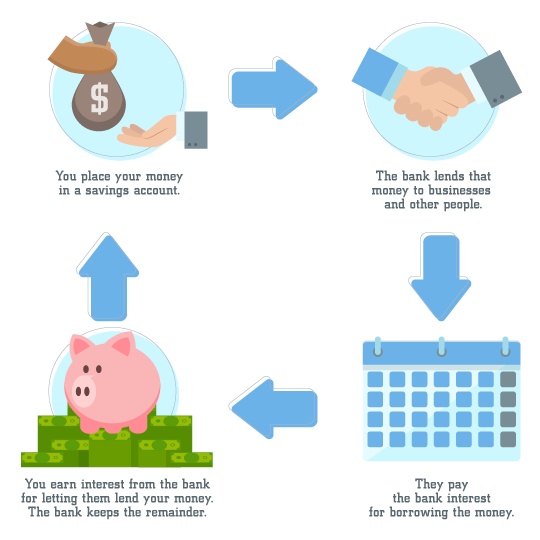

Its a variety of mortgage for which you pay off the money you’ve borrowed and you can any interest recharged to your mortgage more than good lay several months.

Money is month-to-month and you can typically pass on anywhere between 24 and you will thirty years*, although this can be nothing just like the 5 or normally once the thirty-five ages.

In the beginning of the title, a heightened express of your commission is appeal, but not, if you get on the stop of the home loan term brand new mortgage is actually paid down totally and you will probably own the house outright.

Fees mortgages positives and negatives

- Reduces your mortgage harmony

- Even more collection of mortgage loans

- Easier to overpay

- Far more versatile

Memphis savings and installment loan

- High monthly payments

- Less overall to store or dedicate

What’s an attraction-just home loan?

It is a kind of mortgage accessible to get so that investors inside Ireland. They might be not open to domestic borrowers as they are regarded as too high-risk, even if worry about-build mortgage loans are provided as notice-simply for the latest generate months.

Which have focus-simply mortgage loans, your own month-to-month repayment talks about only the desire due to your harmony, not the main city borrowed. It indicates monthly installments was lower, but you will still have to pay off the original mortgage within the conclusion the loan term.

To repay the capital you’ll need to have an intend to pay the balance at the conclusion of the definition of – this might be titled a repayment means that you’ll need comment from time to time.

Interest-merely mortgage loans pros and cons

- Smaller monthly payments

Variety of fees method

From inside the Ireland, there are numerous ways to pay the administrative centre your debt on the conclusion the mortgage name should you choose a destination-only financial.

Possessions financial support

Of a lot landlords like an attraction-only home loan since the local rental earnings always talks about monthly interest and get to allow properties are an extended-name money. A destination-simply home loan entails lower overheads to have landlords who may require to maintain one to or of several services.

Pick so that people normally earn profits regarding house rates increases which is used to repay the administrative centre owed, but this is not protected and you can depends on proper casing field.

Endowment rules

An enthusiastic endowment plan is a type of capital applied for which have a life insurance team. Money is paid down towards policy per month getting a flat time period, which cash is spent.

The insurance policy pays out a lump sum in the bottom of one’s term and the financing are acclimatized to pay off the the financial harmony. Although not, the worth of an enthusiastic endowment rules relies on the fresh investment out-of new fund. In the event that a keen endowment performs poorly it might not be adequate so you’re able to repay what is due.

Pension financial

Retirement mortgage loans are similar to endowment mortgages, although not, a retirement cooking pot supports the loan in place of a keen endowment rules. New swelling-share area of the pension is used to settle the borrowed funds financial support at the end of the phrase, set to correspond having old-age.

If you’re a buy to let buyer and you will offered an interest-merely home loan, you may desire to think providing financial recommendations to help lay enhance fees method.

Are you willing to change desire-just to a cost mortgage?

Yes, you might always re also-financial and switch to a fees financial, providing you see all of the lenders’ value requirements.

Switching to a payment mortgage will increase their monthly payments. To help keep your payments reasonable, you may want to imagine stretching their home loan title however you’ll pay a lot more attention across the identity of the home loan if your help the name.

Another option is to try to move part of what you owe onto a great fees financial and leave certain on your present notice-only mortgage.

Imagine if you can not pay-off their financial?

According to the Central Financial out-of Ireland’s Code out-of Carry out toward Financial Arrears banking institutions have to put in place a method known as Mortgage Arrears Solution Procedure (MARP) to assist consumers whose mortgage is actually arrears or is on risk of starting arrears.

The lending company can offer you an alternative payment plan and you may officially remark the latest plan at least the half a year. Which feedback comes with checking if your situations possess changed since start of the arrangement or since last opinion.

Option payment agreements

Moratorium otherwise repayment break: This enables one to put off investing all the otherwise element of the financial getting a decided, short-time. At the conclusion of new deferment months, your repayments will increase. If for example the repayments is lower than the eye matter owed, their investment harmony also increase.

Capitalisation of arrears: In which your own a good arrears are put into the remaining financial support balance, enabling you to pay-off her or him one another along side longevity of your mortgage. Because of this their home loan will no longer be in arrears but this will improve investment and you can notice repayments across the full longevity of the home loan.

Mortgage name expansion: This enables you to reduce your month-to-month costs but your financial lasts stretched. It can bring about your paying a great deal more attract across the lifetime of one’s financial this will definitely cost alot more altogether.

Interest-only plan: This is when you have to pay only the interest on your own mortgage having a selected limited time frame. This means your capital harmony doesn’t clean out during the plan as well as your month-to-month payments will increase given that plan several months features ended.

Part funding and you will appeal plan: This permits you to pay the complete attract on your own mortgage also build region payments to your home loan harmony having the remainder term of your financial.

Separated mortgage arrangement: So it arrangement breaks your own financial into the several accounts to reduce their monthly costs. You’ll be necessary to generate capital and you can notice costs considering your current monetary issues for one part and also the other region is warehoused and you can fee was deferred to possess a period until the financial factors raise.

After the loan label, new an excellent home loan equilibrium might be owed regardless of the choice repayment arrangement.

If you’re not capable repay this new outstanding home loan completely, you will need to confer with your financial concerning the possibilities offered, that could were, downsizing your residence, financial so you can lease, otherwise selling your house.

While you are troubled financially otherwise are involved concerning your mortgage, contact your financial and/or Currency Suggestions & Cost management Provider to generally share the options.