The fresh mortgagor commonly ft their computations to own qualifying according to the assumption that your particular credit line is actually completely pulled.

You can see the fresh rates supplied by certain lenders right here. Generally, it is essential to just remember that , the pace away from property guarantee financing is dependent on the top financing speed (prime) which is the rate that commercial financial institutions charges their really creditworthy consumers.

Really loan providers add on a margin over the finest rate, and the household security range, needless to say, is based on your credit rating dropping within specific variables and you may the borrowed funds-to-worth of what you’re funding

When deciding if you qualify for a home equity distinctive line of credit, loan providers always assume that the top credit rate movements dos% more than it is into costs date (or maybe more) and look at your ability, centered on finances disperse, to invest back the mortgage with dominant amortization more an effective 20-12 months label. They do which worry decide to try to be certain there’ll be the capability to meet with the mortgage even with fluctuations out of best and a smaller installment period that might be stated in the fresh new financing.

Ms. Bronstein along with explains you to definitely while you are house equity money are usually much more versatile and less expensive than household guarantee loans much less burdensome than just playing cards, they do bear threats and disadvantages.

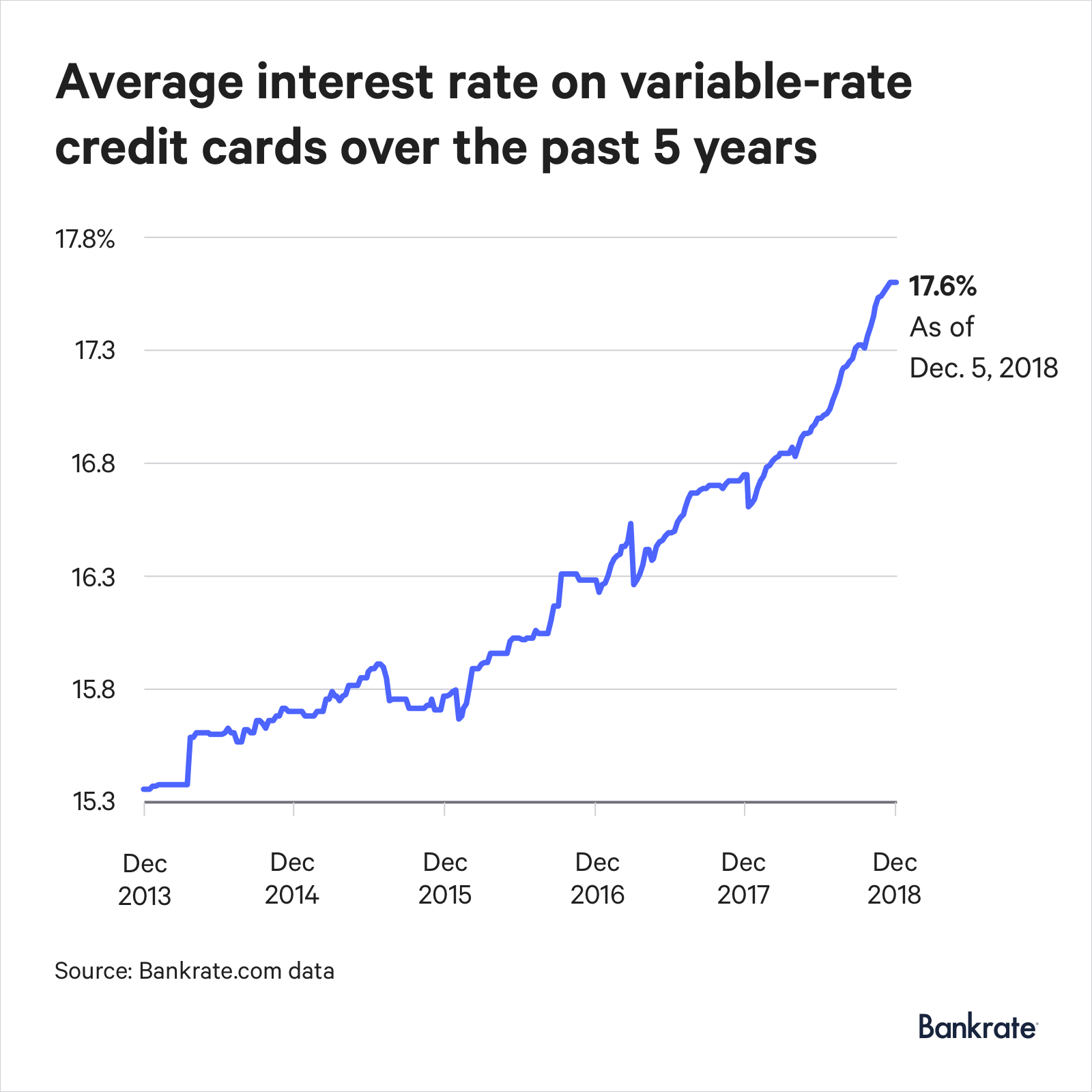

You to definitely real risk when you look at the a property equity mortgage is situated in that repayment terminology is linked with the prime lending price fluctuates, and may vary considerably. The prime lending rates is more planning inches up, instead of off, along the next few years, once the Government Reserve raises the Given Funds price.

Such as, that have primary right now on cuatro.25%, brand new BestCashCow financial re-finance tables show a thirty-year repaired speed out of step three.75% for the big date on the book. One price and that equipment will make a great deal more sense to possess a good borrower who is able to keep the cash-out getting a great very long months. But not, certain consumers looking to keep cash out and you will attracted to brand new down prices get often nevertheless get a hold of household security lines of credit become the item preference, as they can commonly go up to ninety% of worth of the home facing which they are approved, and steer clear of the necessity for individual home loan insurance (PMI).

To own boomers, it is a good time to adopt taking out fully a house guarantee financing (HEL) otherwise family equity personal line of credit (HELOC).

Daily, on 10,000 middle-agers turn 65, the new traditional decades to have retirement or at least, the age whenever the majority of people intend to stop and you will get-off the jobs. Years ago, of a lot retirees you certainly will count on a workplace your retirement and Social Defense experts and private savings to assist them to pay for their advancing years as long as they had smaller monetary requires.

Consumers, for this reason, might also want to become familiar with whether or not it produces even more sense than simply a finances-aside mortgage re-finance

However, today, that’s all altered; Personal Safety has not been remaining rate having withdrawal means and you may rising cost of living, brand new lion’s express away from people don’t give staff member pensions, and stock exchange volatility of some in years past all the but annihilated the personal old-age coupons away from scores of men and you will women approaching or already at the retirement. Increase your offered life span for both men and you may women and it’s really obvious as to why too many dudes and women can be concerned with that have sufficient currency to afford to live on throughout their old age decades. Actually, multiple studies have shown just how woefully unprepared most people are after they visited its old age many years toward average later years deals hanging better lower than $100,000. What https://simplycashadvance.net/loans/long-term/ is a great retiree to-do?