- Lori Coryell along with her husband bought a few home during the Oregon having interest levels less than step 3.5%.

- The new belongings was included with assumable mortgage loans, which permit consumers when deciding to take more a beneficial seller’s established rates.

- Delivering a decreased rates when costs are high is very good, however, https://paydayloancolorado.net/mulford/ customers should be hands-on, Coryell told you.

Which since the-told-in order to article is dependant on a conversation that have Lori Coryell, 62, a resigned Us Air Force veteran who bought a couple of house into the Oregon that have assumable mortgages. (The woman is offering among them, plus which have an assumable mortgage.) An assumable home loan allows qualifying people to get the pace, newest dominant harmony, or any other requirements of a seller’s current financing. Only a few money will be assumed. The brand new article might have been edited to possess length and you may understanding.

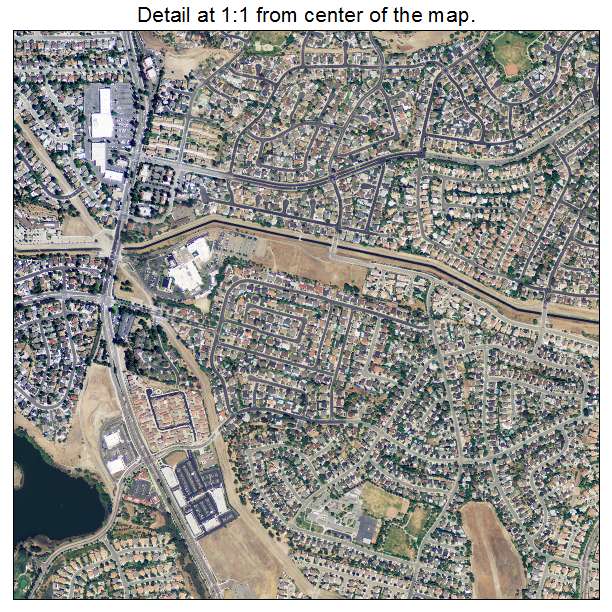

We have stayed in Oregon for almost all from my entire life. Inside the 2020, we purchased property from inside the Beaverton for $650,000 that have a two.5% home loan interest rate.

I’m a good USAF seasoned, therefore the residence’s previous customers write to us your family got an assumable Pros Activities (VA) mortgage. My spouce and i got an interest in which, trusting it may be a secured asset.

That’s because assumable mortgage loans is actually a problem. To the buyer, it can make or crack simply how much house they could afford. As well as for a provider, permits them to number your house at a somewhat highest speed because potential customers will probably see a lower life expectancy attract price.

My spouce and i understood you to rates just weren’t planning stay reasonable forever. So, whenever we chose to promote the home subsequently, the low price, that may transfer to the second consumer, perform work for you just like the suppliers – they generated the entire offer very glamorous.

I got myself a few house having interest rates less than step 3.5%. It’s hard work to make this style of home loan, but it is worth every penny

My personal daughter, who was not likely to get pregnant, wound-up getting pregnant. My spouce and i was basically really happy. It actually was their unique earliest child and you may my first grandchild, and i also understood she would need some help with the little one.

All of our Beaverton house is actually one hour . 5 off in which she resided. I considered that transferring to Gresham, that is ten minutes out, tends to make a big difference.

Into the Gresham, indeed there just weren’t of several virginia homes. That is because collection is actually simple from the Portland city town. I really don’t envision it’s generated the genuine-home business since the aggressive as it was couple of years in the past, however, home prices will always be pretty higher.

Relevant reports

Although there was in fact several neighborhoods that people was basically for example in search of, none of your residential property here came across the requires. All properties required a global remodeling or big updating.

We looked for four to six weeks, and you will come taking frustrated. In December, I stumbled upon a house we really preferred in your neighborhood.

Your house is actually produced in this new 90s and that is 2,800 square feet, which have four rooms and 2? shower enclosures. It was on the market for $620,000, that has been toward luxury, however it got that which we desired from inside the a property, including a master suite into the fundamental flooring.

As i investigate house’s malfunction, they said an assumable mortgage, and that produced your house so much more attractive to united states. We got it having $615,000 and you can wound-up paying the difference between the sales rate and you may whatever they still due toward home, which had been $260,000.

We plus paid back all of them good $10,000 superior with the intention that we can keep their Va entitlement, as mine was already getting used on household inside Beaverton.