- Customer service and you can profile: As you like a lender that gives the borrowed funds you prefer, take into account the company by itself. We wish to run a pals that has a great profile in the business which will end up being responsive if you have issues or need help along with your financing.

Applying for a pool Financing

The procedure to possess obtaining a personal bank loan are very different built towards the sorts of financial you run. For individuals who choose for a classic bank or borrowing union, you may have to apply at a city department or really works having financing broker to complete your application.

If you choose an internet lender for the consumer loan, the program procedure can go some effortlessly. You could potentially over your application on the internet and, normally, apparently easily.

Understand that more pointers your provide on your first application, the more quickly your application could well be processed. If you’re unable to bring proof your earnings or a position, the lender need additional time so you can consult you to definitely suggestions and you can procedure the job.

What exactly is Flexible

As you cannot fundamentally negotiate one areas of your loan, you can increase or ount of monthly payment by adjusting your own payment title.

Having a longer cost identity, there are lower monthly installments. While this appears like the more glamorous option in the deal with really worth, you’ll be investing a whole lot more inside the need for the future.

The latest reduced your repayment label, the higher their monthly payment was. As you pay your loan from quicker having a shorter name, it is possible to pay less from inside the appeal over your loan name. You can even probably rating a lower life expectancy interest rate with a shorter term.

Most useful Pond Funds

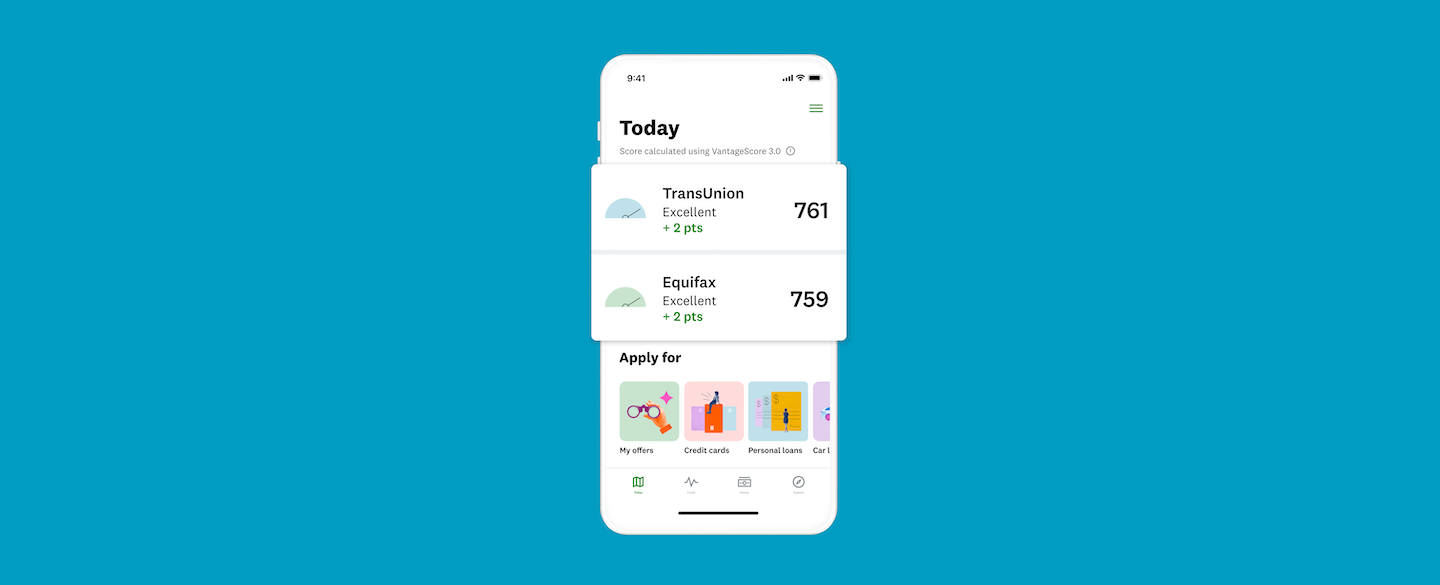

Minimum fico scores necessary to qualify for a pool financing are different from the bank, and some promote fund in order to individuals that have fair if not bad borrowing. not, you will have an informed chance of acceptance with a good otherwise expert credit score. At exactly the same time, a beneficial otherwise expert credit history helps you score an excellent competitive interest which help you be eligible for the total amount your you need.

What is the Label for the majority of Pool Financing?

The fresh payment label to own a personal bank loan essentially ranges in one year to help you 7 many years. Although not, you could potentially achieve a lengthier mortgage term by choosing an alternate financing alternative, such as for example a home collateral mortgage, cash-away refinance, otherwise dealer financial support.

What’s the Average Interest rate towards the a share Financing?

Considering investigation about Federal Set-aside, the typical consumer loan interest into the a good 24-month label are %. Most other financing models, particularly household guarantee funds, might have lower rates of interest. At the same time, their attention tends to be large otherwise straight down predicated on your own credit get.

Could it possibly be smart to Loans a swimming pool?

Be it a smart idea to financing a share hinges on your debts. Whenever choosing be it the best choice to you, imagine how monthly obligations often squeeze into your allowance, just what monetary back-up you have, as well as how the borrowed funds would apply at the most other financial needs.

Is it possible you Roll a share Into your Financial?

You could potentially move the price of a swimming pool in the mortgage having fun with a money-aside re-finance. So it loan carry out improve your latest financial and permit that use over the earlier in the day home loan equilibrium. Then you’re able to use the excessive fund to cover the pool setting up.

The bottom line

There are various approaches to financing a pool, together with personal loans, credit cards, family equity money and credit lines (HELOCs). Before you apply to have a share loan, be sure you are able to afford this new monthly installments and you can whether they complement into your budget and you will economic goals. When selecting a share loan, check out the financing title, interest rate, and you may charges.

- Fees terms and conditions: Consumer loan fees terminology normally range between one year so you’re able to eight years, according to your lender. Consider your monthly budget when selecting a payment name while the going for a shorter otherwise long term can get a primary effect on their percentage matter.