Article Guidelines

Off costs on residential property may differ generally, which can ensure it is difficult to understand how far you may need to store. not, when you’re prepared to get property, there are lots of minimum down-payment assistance to adhere to. Some tips about what you should know before making a down payment towards a house.

A down payment was currency that you pay initial for the a good domestic buy. Moreover it stands for their first control risk yourself. Typically, it is shown as the a portion of one’s full cost. Such as, an effective ten% advance payment to your an excellent $400,000 home will be $40,000.

When you’re ready to shop for a property, you will likely want to make a deposit. The financial will likely then help you finance the rest of the newest cost in the form of a mortgage .

There are financing programs that make it you’ll in order to get a house and no currency off , yet not, and therefore we’re going to safeguards afterwards.

And work out a beneficial 20% downpayment was previously sensed the fresh gold standard for selecting a house, these days, it is just a standard that lenders use to determine if you desire financial insurance rates. Generally out-of thumb, for people who establish lower than 20% towards the a traditional loan , lenders will require you to bring individual mortgage insurance coverage (PMI) .

Fortunately, it’s not necessary to make you to definitely large from a down-payment to purchase a home in the present was just 8% for earliest-date homeowners , based on research throughout the National Relationship away from Real estate professionals (NAR). Having recite customers, the average try 19%.

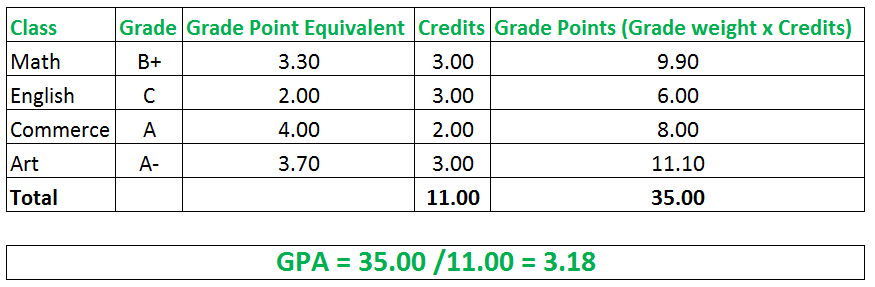

Homebuyers could possibly get confuse how much they need to establish to the an effective home with the minimum requirements put from the lenders. The fresh new desk lower than also provides a quick look at the minimum count needed for each loan program.

Antique finance: 3% deposit

Specific old-fashioned loan programs, for instance the Fannie mae HomeReady mortgage and you may Freddie Mac House It is possible to mortgage , accommodate down costs only step three%, provided your see particular money limits.

You will you desire a slightly higher credit rating. The latest HomeReady loan demands a minimum 620 score, because House You can mortgage wants at the very least a 660 score.

FHA loans: step three.5% downpayment

You could shell out only step three.5% off which have financing backed by this new Federal Construction Government (FHA) – for those who have no less than a good 580 credit rating. The brand new down-payment minimum on the a keen FHA mortgage leaps so you’re able to 10% in the event the credit history was between five hundred and 579.

Va fund: 0% down-payment

Eligible armed forces provider members, veterans and you can thriving spouses could possibly get that loan guaranteed by the You.S. Agencies off Experts Factors (VA) that have 0% down. While you are there’s no called for minimal credit score having good Va mortgage , many lenders will get impose their own qualifying criteria.

USDA financing: 0% downpayment

The fresh You.S. Agencies personal installment loans Clearview WV of Farming (USDA) has the benefit of 0% downpayment lenders in order to qualified lowest- and you can moderate-money homeowners from inside the designated rural components. There is no lowest credit history necessary for a great USDA loan , but most lenders expect you’ll discover no less than an excellent 640 get.

Jumbo fund are finance which can be bigger than brand new compliant financing constraints place of the Government Homes Financing Agencies (FHFA). For their dimensions, these funds cannot be guaranteed because of the Fannie mae and you will Freddie Mac computer , the 2 firms that give financial support for most mortgage lenders.

Thus, these types of funds are usually thought riskier having lenders, so you can easily tend to you prefer a more impressive deposit to be accepted.

Like most monetary decision, and then make a huge downpayment has its own positives and negatives. Here’s a review of what things to thought before you could to go.

Straight down attention charge: Given that you might be credit shorter order your family, you’ll be able to shell out lower attention charge along side longevity of the mortgage. Additionally, lenders can provide your a far greater interest since they will certainly come across your while the a quicker high-risk debtor.

Significantly more security: Your home security is the percentage of your property which you own downright. Its measured by the house’s current really worth minus the matter you owe on the financial. The greater number of collateral you have , the greater you can power that it house.

Less of your budget on hand: To make a more impressive down payment often means you will have less overall accessible to build fixes otherwise fulfill almost every other monetary needs, such building an emergency funds or coating needed domestic solutions.

Prolonged time for you to save: Putting down 20% often means that savings objective is pretty highest. Thus, it requires lengthened becoming a citizen than for people who produced a smaller sized down-payment.

Long-title pros: Some of the benefits of and make a larger down-payment is actually supposed to help you out ultimately. If you are not considering staying in your house to have a when you are, you do not work with as often.

Just how much should you decide set out on property?

Sadly, there isn’t any one to-size-fits-all the cure for how much cash their down payment is going to be. It does trust the newest information on your debts. At all, while there are numerous advantageous assets to and also make more substantial downpayment, paying excessive upfront to possess a property could make you feel house-terrible and you may not able to subscribe to your most other monetary desires.

It is critical to play around with various down payment scenarios up to your home to the one that feels preferred for you. When you find yourself only starting exploring the way to homeownership, our house affordability calculator helps you decide what downpayment may be effectively for you.